Tender Management could Make or Break your Business

Rising dependence on tenders as an efficient procurement strategy for medicines in public and private hospitals has created new opportunities and challenges for suppliers. Currently, ~25% of all business in the pharmaceutical sector is already coming from tenders or contracts.

Many countries are considering ways to enhance purchasing power through providing greater transparency, improving health outcomes, reducing costs, managing therapeutic freedom, and encourage innovation though centralization.

For instance, in Canada, Quebec and Ontario have recently announced an intention to move to a “centralised” procurement and/or supply chain model for all government and broader public sector institution to reduce red tape and costs.

While tendering is widening market access and provides global opportunities, it is also highly complex. Managing them and winning them with better margins is a very difficult task. The impact, in terms of pricing, channel strategy, business planning, manufacturing schedules or data exchange, reverberates across brands, corporate silos and national boundaries.

The expected volume-based discounts are posting challenges for suppliers. In Europe, authorities that use eProcurement report savings of between 5% and 20%. In South Africa for (between 2003 – 2016), the prices of medicines in most tender categories in the public health care system dropped by an average of around 40% or more.

Tenders are also characterized by diversity and unpredictability. Conditions may vary significantly from market to market, subject to factors such as seasonality, level of need, available budget, industrial policy, competition or pricing trends.

As a result of these multifaceted challenges, tender management is not just about pricing, but has several other issues like maintaining margins, demand forecasting etc.

Some of the key market tender management issues are discussed in the following sections:

Tender Tracking

While timing is crucial in competing for tenders might be organised on an ad hoc basis that frustrates cycle planning and demand forecasting.

These challenges may be exacerbated by lack of transparency in price points for tenders.

These challenges may be exacerbated by lack of transparency in price points for tenders.

Transparency initiatives by several public procurement agencies has allowed suppliers to access additional information that assists in managing tenders better. Most suppliers have dedicated teams that spend considerable time in tracking tenders.

Most suppliers rely on past experiences and industry relationships to track and submit bids. As a result, there is a significant number of know unknowns and unknown tenders that are missed by players.

Automation, of this process helps tracking more buyers and preparing a calendar based on prioritisation. Our experience suggests that most companies miss out on key tenders. As per European commission 30% (€ 525 Bn) of contracts in healthcare last year had no bidders or just one-bidder in the contracts process.

List to net price analysis

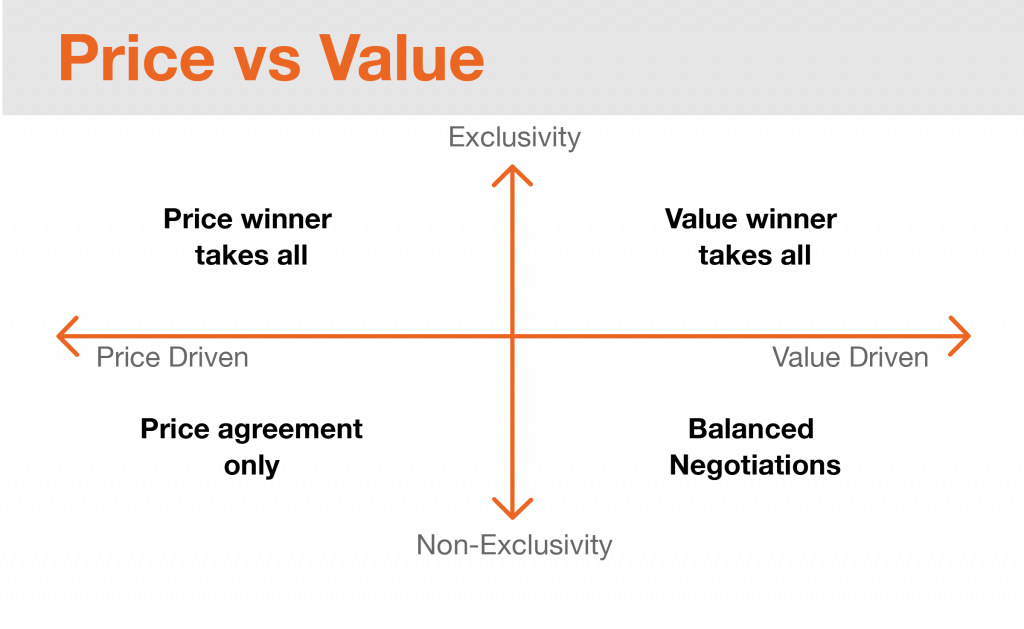

Poor tender pricing strategy can have a significant impact on business performance. One of the major challenges is the lack of competitive intelligence. Further, actual vs estimated consumption by buyers also differs significantly.

Traditionally, most suppliers relied on sample based primary and secondary research along with analytics to estimate the ideal price for the tenders. Lack of competitive positioning, expected competitive behavior, historical reference etc. leads to unscientific approaches that result in high failure rates.

In the new scenario of greater transparency by buyers, centralized procurement approach and availability of new technologies (like machine learning and AI) a more scientific approach can be followed. List to net price information from millions of tenders when analyzed using geographic, PLC, volumes filters help defining discounting strategies. Higher accuracy results in higher win and compliance rates resulting in higher ROIs.

Suppliers need to follow a structured, proactive approach to secure volume and avoid being trapped in a continuous price erosion cycle. An accurate list to net price analysis helps in better usage of pricing lever.

Tender Guidance

Tailor made tender strategy allows for better targeting of sophisticated public tenders. This helps in improved product mix, market access and sales force allocation.

To achieve this, suppliers need to invest in market intelligence and develop capabilities of frontline team members to interact effectively with procurement teams.

Suppliers must also use outcome simulations based on a comprehensive historical buyer data and competitive strategies. Unlike the traditional guestimate approach; suppliers are now using deep dive analysis of outcomes to understand competitive behavior.

Suppliers must also use outcome simulations based on a comprehensive historical buyer data and competitive strategies. Unlike the traditional guestimate approach; suppliers are now using deep dive analysis of outcomes to understand competitive behavior.

Considering the supply chain assurances being challenged during Covid-19, buyers are likely to push for reliability of supplies as an important criterion. Suppliers can explore tender shaping options for long term contracts. This could result in consistent demand irrespective of the price of the product.

Presently, there are a few tenders that attract more than 25 bids; while many have one or less bids. In the long run we are likely to see a more evenly distributed bidding as suppliers will follow a targeted approach based on their strengths.

To learn about Vamstar’s consulting services, including pricing analytics, value-based procurement, tender advisory and more, visit http://www.idlewolf.com/consulting-services/