Insulin Market Buzzing with New Entrants and Innovations

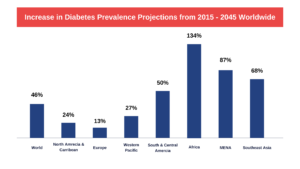

Diabetes is one of the largest global public health concerns, imposing a heavy global burden on public health, as well as on socio-economic development. The International Diabetes Federation (IDF) have estimated that, in 2017, 451 million adults worldwide lived with diabetes and projected that this number would increase to 693 million by 2045.

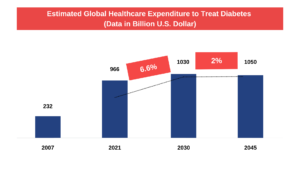

Global costs of treatment

With the increase in prevalence of diabetes, the global costs of treatment and their consequences will rise substantially by 2045. Between 2021 and 2045, the global expenditures for diabetes treatment are expected to grow from 966 billion U.S. dollars to just over one trillion U.S. dollars, with a CAGR of 9%.

Among all countries across the globe, the United States and China have some of the highest medical expenditures. Losses in Gross Domestic Product (GDP) worldwide, from 2011 to 2030 and including both the direct and indirect costs of diabetes, will be €89 billion in Europe.

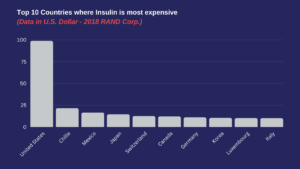

A 2020 study by the RAND corporation revealed that the manufacturer price of several forms of insulin is five to ten times higher in the U.S. ($98.70 USD) than in all other OECD countries ($8.81 on average).

Insulin procurement in Chile

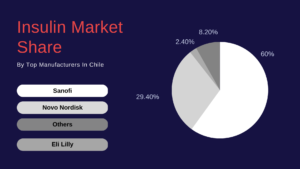

In South America, Chile specifically, the insulin procurement market in 2022 was $4238.019.184 CLP. Sanofi, Novo Nordisk and Eli Lilly have dominance of the market shares, with 60%, 29.4% and 2.4%, respectively.

Where insulin is the most expensive

Insulin is the most expensive in the U.S, a price that is almost 5 times higher than the next most expensive country, Chile. Africa and Latin America are also offering interesting opportunities, with large patient pools and high margins.

Five most expensive countries for each insulin type

| Apidra (Insulin glulisine) | Humalog (Insulin lispro) | Novolog (Insulin aspart) | |||

| South Africa | $74 | Brazil | $89 | Kenya | $33 |

| United States | $61 | Switzerland | $80 | Thailand | $67 |

| Grenada | $50 | United States | $55 | Uruguay | $50 |

| Morocco | $48 | Dominican Republic | $50 | United States | $46 |

| Philippines | $39 | Costa Rica | $48 | Bolivia | $29 |

| Humulin (Regular insulin) | Levemir (Insulin detemir) |

Lantus (Insulin glargine) |

|||

| Philippines | $39 | United States | $53 | Kenya | $258 |

| South Africa | $38 | Morocco | $28 | Panama | $80 |

| United States | $33 | South Africa | $16 | Uruguay | $50 |

| India | $16 | Uruguay | $13 | Peru | $49 |

| Ecuador | $9 | Indonesia | $7 | United States | $41 |

Insulin manufacturing

Insulin production is concentrated in three large multinational companies – Eli Lilly, Novo Nordisk and Sanofi (known as “the big three”). They have a 94% share of the insulin market, by volume, and hold a share of USD 24 billion of the global insulin market.

New entrants in the market are increasing the competitive intensity, with product registrations across the world. Institutional sales are the low hanging fruits for these new players, with volume-based discounting strategies.

The estimated manufacturing cost of most insulin, human and analogue, ranges from $2.28 to $6.34 per vial. In the past two decades, prices for the most prescribed insulins have increased from around $20 per vial to over $250 per vial – a more than 700% increase, after adjustment for inflation. A combination of factors drives the final price. These include: rebates, fees negotiated among the supply chain stakeholders and the insurance status.

| Global Rank | Company Name | Number of Reviewed Countries Where They Sell Insulin | Percent of Insulin Market (by revenue) | Percent of Insulin Market (by production) | Major Insulin Products |

| 1 | Novo Nordisk | 111 | 41% | 52% | Actrapid®, Insulatard®, Mixtard®, NovoLog®/ NovoRapid®, NovoMix® |

| 2 | Sanofi | 101 | 32% | 17% | Apidra®, Insuman®, Lantus® |

| 3 | Eli Lilly | 94 | 20% | 23% | Humalog®, Humilin® |

| 4 | Bioton | 26 | Unknown | Unknown | GensulinTM, SciLinTM |

| 5 | Wockhardt | 17 | Unknown | Unknown | Wosulin® |

| 6 | Biocon | 17 | Unknown | Unknown | Basalog®, Insugen® |

| 7 | Julphar | 13 | Unknown | Unknown | Jusline® |

Recent Trends in the Insulin Market

- Oramed is looking to develop oral diabetes medication from medication that is currently in the form of injectables. It says its proprietary lead candidate has a potential to be the first commercial oral insulin capsule for the treatment of diabetes.

- Novo Nordisk has developed Insulin Icodec, which reduces the number of insulin injections needed on a yearly basis from 365 to 52. It will be a weekly dosing regimen.

- Tandem’s mobile blousing: Tandem Diabetes Care will likely be the first to cross the finish line in getting FDA clearance on a smartphone app that can be used to control an insulin delivery device.

- Omnipod 5 (formerly Horizon) connects the Omnipod tubeless patch pump to a CGM, via a smart algorithm. This allows for automatic insulin dosing adjustments.

- Medtronic 780G, also known as the Advanced Hybrid Closed Loop (AHCL) system – an automation of glucose. The Minimed 780G advanced hybrid closed-loop (ACHL) system adapts basal infusion rates and delivers auto-correction boluses in order to achieve a user-decided glucose target (100, 110 or 120 mg/dL)

If you would like to find out more about insulin procurement or how Vamstar can help you, please reach out to start working together. Find out more about us here, http://www.idlewolf.com/

Insulin | Value-Based Procurement | Healthcare | Artificial Intelligence | Diabetes | Medicine | Telemedicine | Buyers | Suppliers | Supply Chain | Patient Care | Big data | Consumables | COP27