Recent LoEs have seen a more rapid price erosion, especially in the first 60 days.

The year-on-year increase in the number of molecules going off-patent is having a significant impact on the pharmaceutical industry. Originator companies are facing increasing competition from generics and biosimilars, and they are also having to invest more in research and development to replace the drugs that are going off-patent.

In 2023 and 2024, a record number of blockbuster drugs are expected to go off-patent. This will have a significant impact on the revenue and profits of the originator pharmaceutical companies that own these drugs. The increase in the number of molecules going off-patent is due to:

- The ageing of the pharmaceutical patent cliff: Many of the blockbuster drugs that were patented in the 1990s and early 2000s are now coming off-patent.

- The increasing complexity of drug development: New drugs are taking longer and longer to develop, which means that they have less time under patent protection.

- The rise of generic and biosimilar competition: Generic and biosimilar drugs are becoming more and more available, which is putting pressure on the prices of branded drugs.

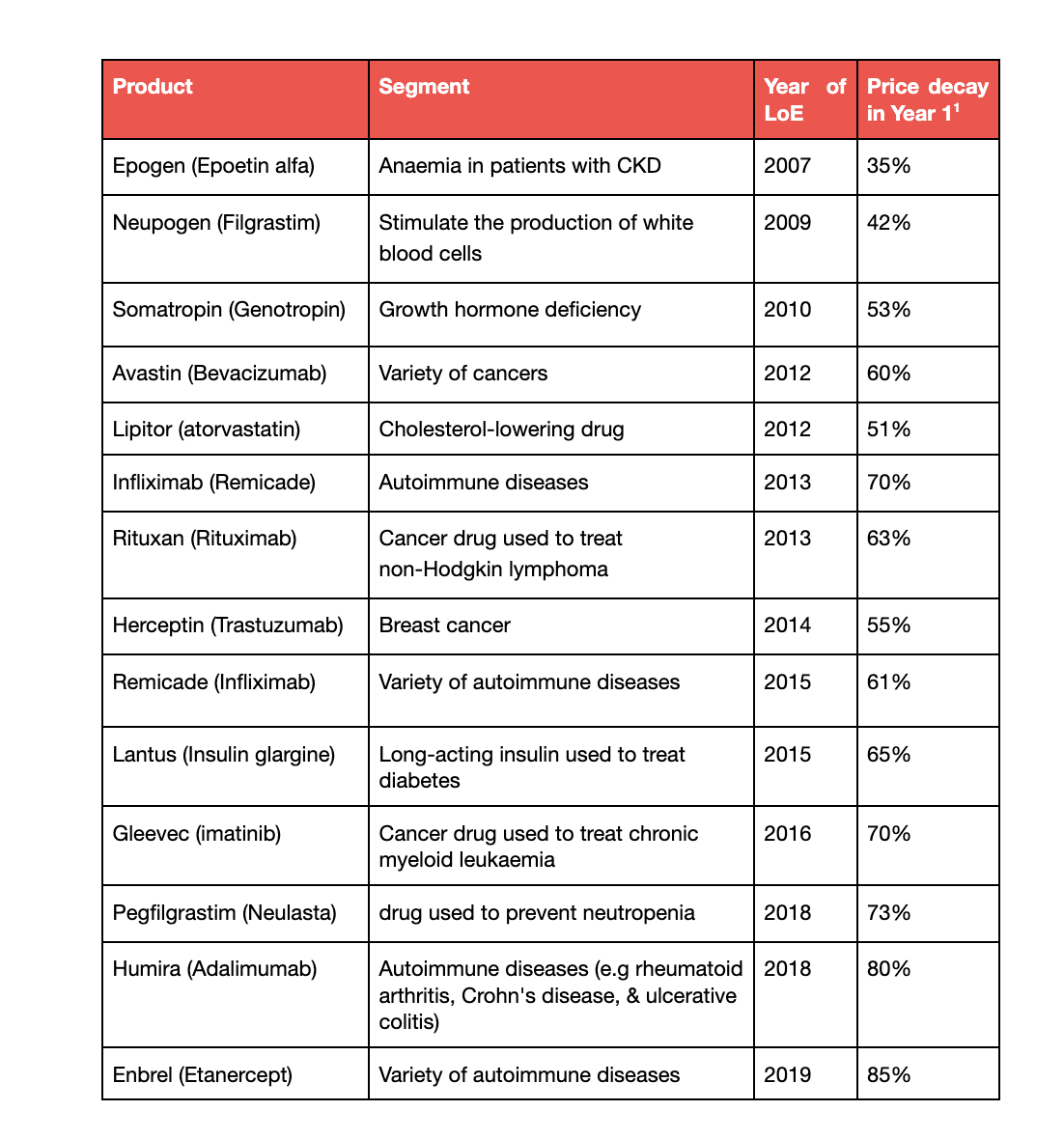

As a result, the market has become more dynamic due to the entrance of stronger and more aggressive generic manufacturers. In recent years, there has been a trend towards increased price erosion for pharmaceuticals post-loss of exclusivity (LoE).

The average price decline for branded drugs after the loss of exclusivity in the Europe was 58% in the first year and 62% in the second year between 2002 and 2014. For oral medicines, the price decline was even greater, at 66% in the first year and 74% in the second year.

![]()

- The increasing number of generic manufacturers entering the market and the increasing sophistication of generic manufacturers, allow them to produce high-quality generic versions of complex drugs. Most generic manufacturers follow an aggressive pricing strategy to gain market share rapidly.

- Many governments have implemented policies to encourage the use of generic drugs, such as requiring pharmacists to dispense the cheapest generic version unless the prescriber specifically states otherwise.

- Cost pressures on buyers post-pandemic resulting in revised procurement strategies. Many buyers have now launched fresh tenders immediately upon patent expiry to maximise benefits. Special import licenses and faster approvals are also granted to ensure supplies from low-cost generic manufacturers.

Post-pandemic and economic slowdown, buyers are under increased pressure to reduce spending. As a result, many buyers are now amending their procurement cycles to maximise the benefits of generic products and ensure long-term supplier relationships.

As a result, the price decline is more immediate with over 60% of decay taking place in the first 30 days. For Instance, in 2022, the price of Alimta (pemetrexed), a cancer drug, fell by 80% in the first six months after generic versions entered the market in the United States. Similarly, Suggamadex has already seen an 80% decline in the first 30 days in a few European countries.

While the decay continues to be high in the case of orals, the recent trends in injectables show a sharp decline, especially in the first 45/60 days. The generic suppliers have also realised that such aggressive discounting strategies may result in a significant loss of margin. The key challenge for the suppliers is getting the discounting strategy right as it affects the long-term commercial viability. Most suppliers lack the tools and visibility (insights) in key markets to help them define a pricing strategy.

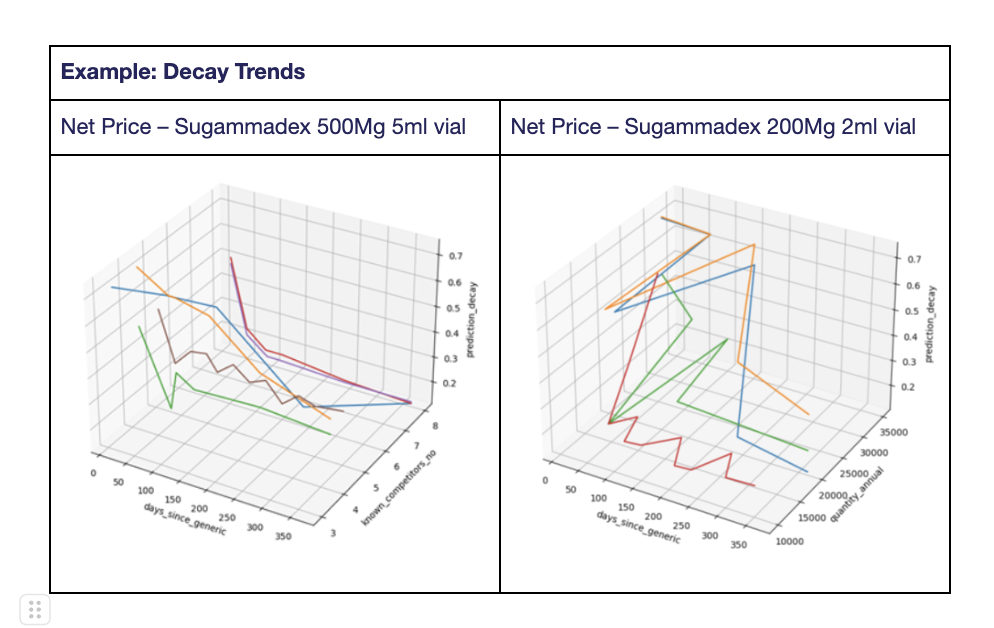

Vamstar’s Price Forecasting Model for LoEs

Vamstar’s loss of exclusivity (LoE) model analyses examples of previous Loss of Exclusivity (LOE) in comparable products across key European markets. It estimates the expected decay in price per unit based on the tender award dates from the date of LOE.

The factors included in the analysis are:

- Number of active participants

- Aggressive nature of suppliers and their pricing archetypes

- Date of LoE (More rampant depreciation has been witnessed in recent times)

- Treatment costs (high-value products see a more rapid fall)

- Product complexity (small molecules/ biosimilar/ line of treatment etc.)

- Volume-based discounts and

- Originator’s strategy.

With the rise in the complexity of players, the dynamic nature of the tendering markets and the buyer’s willingness to secure larger discounts, AI has the potential to model that behaviour by analysing data points and their relationships in a multi-dimensional environment. The ability of AI to analyse patterns among several variables and identify interdependencies.

The power of AI can be leveraged to analyse the tender (net price) data across markets based on analogues. We identify data trends for similar molecules (in terms of form, treatment pathway, channels, geography etc.). The price forecasting model that Vamstar has developed can estimate the per-unit award price in multiple scenarios to act as a guiding light for pricing strategy in rapidly decaying markets.